13 October 2023 by Dr Tim Coles

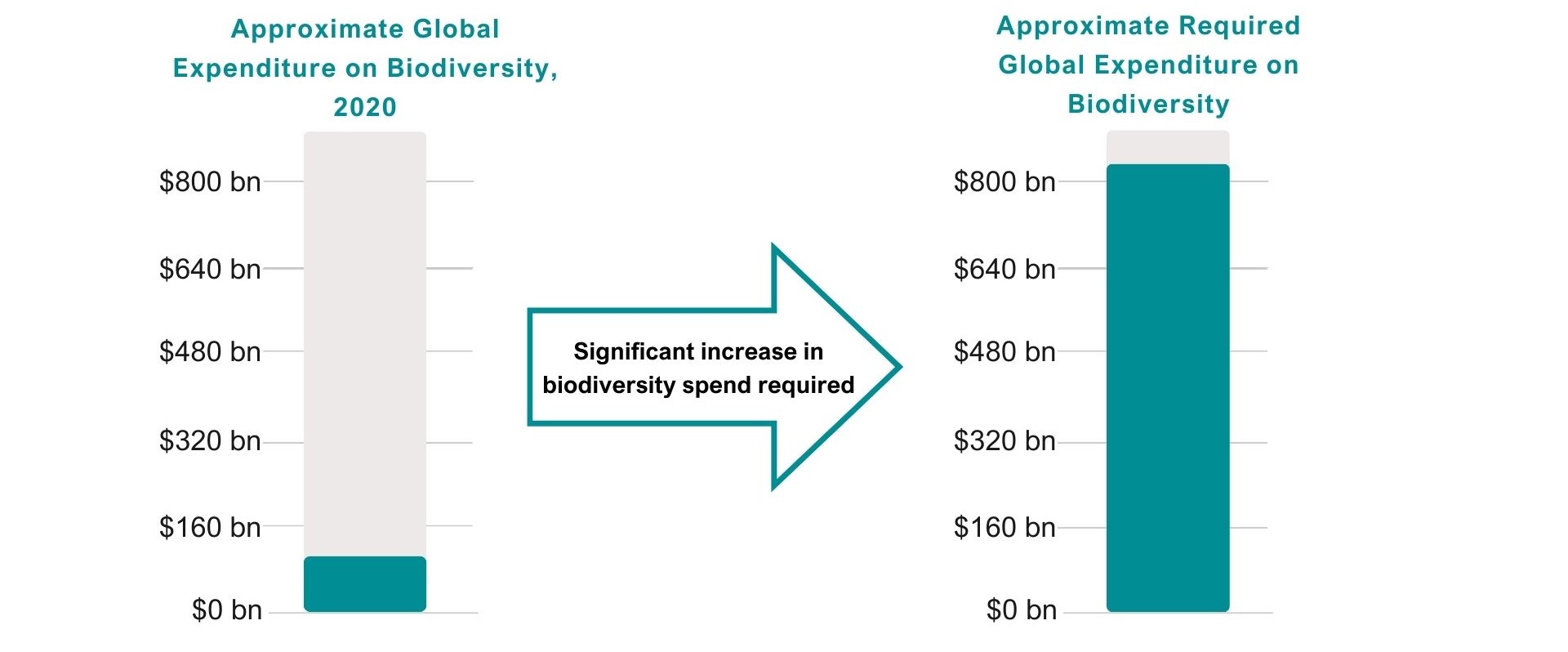

At COP15, countries committed to restoring at least 30% of degraded terrestrial, freshwater and marine ecosystems by 2030 and to conserving and managing a minimum 30% of the land, freshwater and marine areas by 2030. The Nature Conservancy has estimated that the financing needed to meet these COP15 targets is between $598 billion and $824 billion per year. It is apparent that national and international government spending will not meet these financing requirements, as despite it constituting 86-92% of all global expenditure on biodiversity in 2020, it only amounted to $78 – $90 billion.

The private sector forms more than 70% of the total economy in most countries which raises the question: Why is it not helping with biodiversity spend? This question appears even more strange when total global spend on carbon trade (mostly compliance) was around $865 billion in 2022, with much of this funded by the private sector. Surely it would make sense to divert a significant percentage of this existing spend towards ecosystem restoration which both sequesters carbon and improves biodiversity? Indeed, if private sector funding is not corralled into helping prevent biodiversity decline how will developing countries, that have huge areas of degraded ecosystems, ever afford to meet their COP15 restoration targets?

rePLANET was created to demonstrate that private sector funding from both corporates wanting to retire carbon and biodiversity credits and investment funds wanting to re-sell credits on the secondary market can drive ecosystem restoration. This will be achieved by directing a significant proportion of current carbon spending towards ecosystem restoration to fund both biodiversity and carbon. One company cannot solve this problem, so our founding principles encourage helping others in the sector use similar approaches, on the basis that they in turn support others to adopt this same approach and cascade the learning.

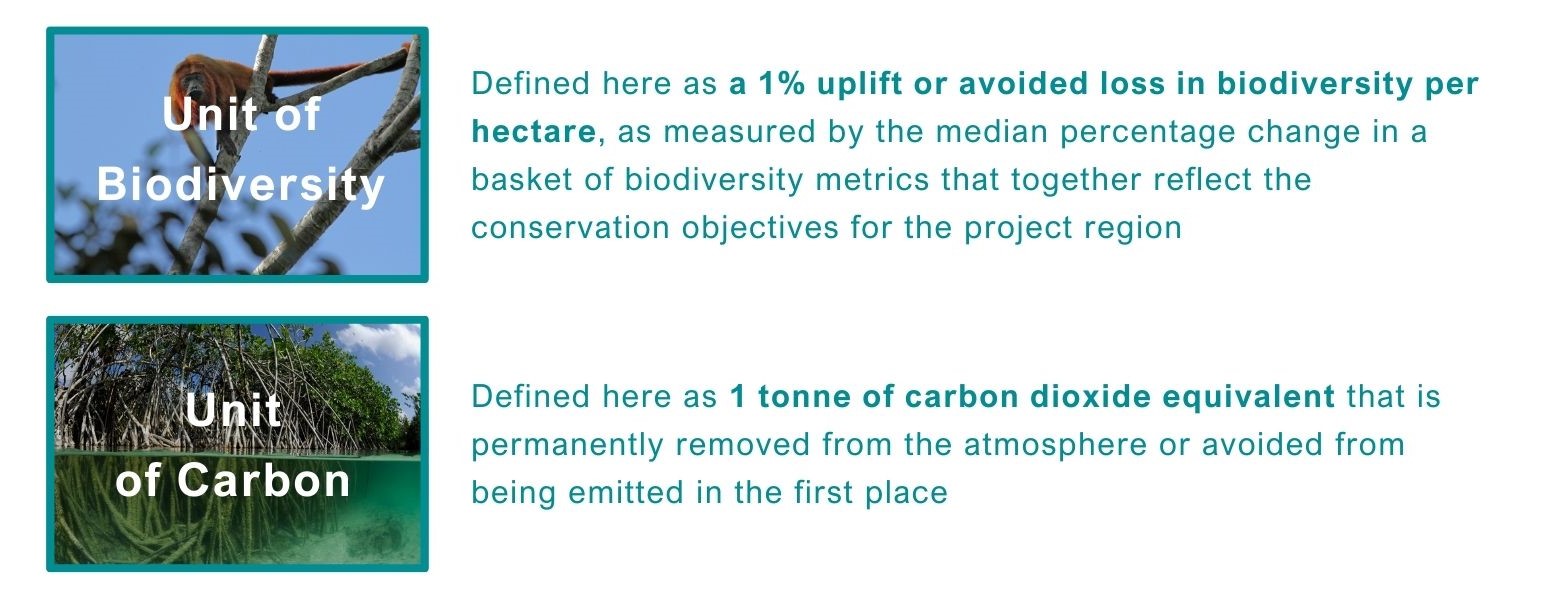

A major reason for the outlined disparity in biodiversity and carbon spending is the longstanding challenge of quantifying the benefits of biodiversity investments; a standardized unit of gain was urgently required alike that of the agreed unit of climate change: 1 tonne of carbon dioxide equivalent. rePLANET worked with the Wallacea Trust to address this major barrier to ecosystem restoration funding and after a rigorous international consultation exercise, we developed a biodiversity quantification methodology and an agreed unit of biodiversity gain (uplift or avoided loss).

The resultant Wallacea Trust methodology is open source and free of charge to use by any organization. This consultation exercise and subsequent revisions has led to a suggested unit of biodiversity gain being defined as: a 1% gain per hectare in the median value of a basket of taxa that reflects the conservation objectives for the habitats in the project site. Now, if a company invests in a series of conservation projects, they can report these in a standardized format for ESG reports e.g. we have invested in a series of projects that together have achieved a 20% increase in biodiversity over 10,000 hectares in the last 3 years. Additionally, corporates and investors interested in monetizing these claims can do so by issuing 80% of the overall biodiversity gain as credits; 20% of the claim must be retained as a buffer.

Without independent verification how can such biodiversity claims be believed? The Biodiversity Futures Initiative (BFI) have addressed this issue by forming an independent group of academics with leading expertise in a range of taxa, ecosystems and ecoregions that provide independent verification of biodiversity claims using the Wallacea Trust methodology. Credit issuance is then completed using registries on either block chain or more traditional systems. rePLANET’s adoption of the BFI approach prevents the over-issuance of project credits by removing the conflict of interest that traditional certification bodies face as they are paid by the number of credits issued (see Guardian article). BFI verification and validation of the size of biodiversity claims is completely independent of the registry issuing the credits.

A key rePLANET commitment is that the local stakeholders (land owners, users and managers) for any given project receive a minimum of 60% of the financial benefits. This is done in line with the Plan Vivo principles for the issuance price of credits. However, we are deliberately pitching credit prices below market rates to attract mass scale investment where the investors get a return on their investment. This means that if a blue carbon credit is issued at $15 and then resold at $30 the local stakeholders have only received 30% of the final value of the credits. Therefore, all rePLANET contracts with investors require that 60% of any profits made on resale of credits are paid as a bonus to local stakeholders; this ensures that the local stakeholders always get 60% of the market price for the credits.

To summarize, rePLANET projects are funded by the sale of carbon with either the biodiversity co-benefits quantified via the BFI or alternatively where the buyer also wants biodiversity credits they are issued as separate credits. A minimum of 60% of the total income raised from these projects goes to local stakeholders and prices offered to investors are such that they can make a good return on their investment which then generates mass interest in funding our ecosystem restoration and conservation projects. rePLANET want to demonstrate that this approach can work in 5 separate markets which will be explored in our next blog.